Everything you need to know about spending money while studying abroad in London.

Knowing about the currency, exchange rate, and credit cards will help you be prepared for your time abroad. Also, knowing the difference between the pound and the euro will be helpful if you plan to travel outside of England. The currency in England is very similar to the United States, which makes it easy to learn. Taking the proper steps to ensure your credit card will work overseas is critical before you leave the country or you can run into trouble. This quick guide can be used as a tool for students getting ready to study abroad in London and ensuring they are prepared and knowledgeable about what to expect when spending money.

Great British Pound (GBP)

The Great British Pound (GBP), referred to as the pound sterling or pound for short, is the basic unit of currency in England, as the United States Dollar is in states. The sign for the pound is £. Pennies are referred to by the plural term pence, but the conversion is the same as the United States: 100 pence makes one pound. Currency in England leans more toward coins than bills. The one pound coin is used often and you’ll find yourself carrying around more coins than notes. Unfortunately, the change can add up quickly and be heavy. I would recommend having a small pouch you carry around to keep the coins in so they are not loose. I purchased a small bag to carry around that had a perfect size pocket for the coins.

Coins and Notes

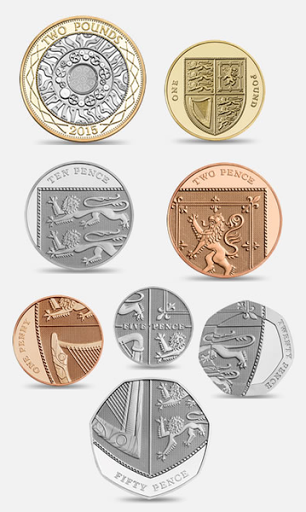

The coins are 1 penny, 2 pence, 5 pence, 10 pence, 20 pence, 50 pence, 1 pound, and 2 pounds. Pence is the plural version of penny. You will typically see it written as 50p and pronounced 50 “pee”. In 2008, they introduced a new version of coins into circulation. While I was studying abroad in 2011, I came across several of them. If you put the 1p, 2p, 5p, 10p, 20p, and 50p together they create the shield that is shown on the 1 pound coin. The design of the 2 pound coin represents the technological development. All of the coins vary in size, shape, and metal type so it is easy to tell them apart.

The bank notes are the 5 pound note, the 10 pound note, the 20 pound note and the 50 pound note. Each note has its own size and colors so they are easy to distinguish. It is easy to tell the difference between each note, but the down side is that they do not fit in your wallet easily because some are taller and will stick out if you try to put them in like dollar bills. Keep this in mind when you are deciding how to carry money.

The Euro

The euro is the official currency of the European Union and is commonly used through much of Europe. While it is not an official currency in London, you can still find places where it is accepted.

Exchanging Money

Exchange rates will vary as you travel, and in tourism areas you will frequently see places where you can convert currency, including American cash and euros into British pounds. Rates are often very clearly posted and might seem competitive, but if you look at the small print or ask the money changer, you will find that there are associated fees, either a flat charge or a percentage of the money changed. This can add up. You are better off exchanging cash at a bank or using an ATM.

Debit and Credit Cards

Using a debit or credit card overseas can be a great convenience, but in England, as in much of Europe, credit card transactions are often accompanied by the need to enter your PIN. This is standard for debit cards in the United States, but not with credit cards. Before traveling to London, obtain a PIN for any credit card you plan to use. Some stores will print out a receipt for you to sign instead, but you should be prepared nonetheless. Also, check with your bank before you leave to find out if there are any fees or extra charges associated with using your debit or credit card overseas, such as currency conversion charges. Visa and Mastercard are widely accepted in London's restaurants, bars, cafés and shops. American Express cards are less commonly accepted.

In my experience, you will quickly notice a major difference once you arrive and feel like the US is very behind on credit card technology. In the UK, everyone has a chip in their card and when they go to pay they will insert the card, enter their PIN, and when the transaction is complete they will pull their card out of the terminal. Some US banks have recently started moving to the chip and PIN cards, but it will be a noticeable difference when you are overseas. Most businesses will still be able to take your debit or credit card, but they will swipe it and want to see identification to ensure the signature on the back matches. They will hold on to the card until the entire transaction is complete - this is normal.

The most important thing is to make sure your bank and/or card issuer is aware you will be in another country and what dates you will be there. When I contacted my bank, they also gave me a phone number that I could call in case my card was frozen that would allow me to unlock it. Unfortunately, my card ended up being frozen two different times, but the phone number made it easy to unlock. Be prepared for the worst case scenario and make sure you have some cash on hand just in case.

ATMs

ATMs are common in London. You can use your debit card or a credit card to withdraw cash in pounds from any ATM simply by using your PIN. When you do so, the bank will automatically calculate the exchange rate and debit that amount, in US dollars, from your account. But, be sure to check with your bank for hidden exchange fees that can accrue each time you make a transaction and try to limit the number of withdrawals to keep the extra costs down. Your bank, or the U.K. bank, also might charge you a transaction fee. When it comes to using ATMs, I would recommend only using ATMs of banks you become familiar with such as HSBC or Barclays, two bank ATMs I typically used, so you know the ATMs are safe. Also, using ATMs where you have to go inside are safer.

Exchange Rate

The exchange rate is something that will quickly become a part of how you look at prices while you are in London. The exchange rate currently is about £1 for $1.55. The exchange is in favor of the GBP. Therefore, if you were to spend £16 on a meal you would be paying almost $25. Budgeting was a critical part of my trip because I set aside a specific amount of money for the 6 weeks I was living in London. Although the exchange rate made it a bit more expensive, I was able to learn how to live on a budget and still be able to see many sights and enjoy London.

Hopefully this information and the useful tips are able to help you with spending money in London. Once you get the hang of the currency and can quickly calculate the exchange rate in your head, you’ll be spending money like a local!

Read more: An Easy Guide to Understanding VAT: Understanding Taxes in London

Heather Robinette is the London Study Abroad Editor for Wandering Educators. She notes, "During the summer of 2011, I studied abroad for six weeks in London at the University of Westminster with Academics Programs International. I graduated from Kansas State University in Manhattan, KS in December 2012 with a Bachelor of Science in Business Administration. I currently work as a marketing analyst for a small company in central Texas. I am also pursuing my MBA. While I was abroad in London, I was able to create many unforgettable memories that I will never forget! My study abroad experience helped me gain various skills, but above all else, it helped me to learn more about myself and the world around me."

All photos courtesy and copyright Heather Robinette, except coin images: http://www.royalmint.com/